florida death inheritance tax

Legislation provides that in 2026 the estate tax exemption threshold will revert to the 2017 level of 549M. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

Taxes In Florida Does The State Impose An Inheritance Tax

In Florida there are no estate or inheritance taxes.

. Florida does not have a separate death or. This exemption is a highly politicized issue and in our firm. The good news is Florida does not have a.

In 2012 Mom deeds the house worth 110000 BEFORE she dies. If the decedent was unmarried at the time of death and left no will but had one or more surviving descendants those descendants receive the entire. Spouses in Florida Inheritance Law.

There is no inheritance tax in Florida because the property that is inherited does not count as income for the federal tax guidelines. This tax is different from the inheritance tax which is levied on money after it has been passed on to. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

Inheritance Law for Unmarried Decedents. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth. You sell the house after she dies.

Florida doesnt have an inheritance or death tax. A federal change eliminated Floridas estate tax after December 31 2004. The Federal government imposes an estate tax which begins at a whopping.

However the federal government imposes estate taxes that apply to all residents. Florida does not have a separate inheritance death tax. Inheritance tax doesnt exist in Florida at any level.

Previously federal law allowed a credit for state death taxes on the federal estate tax return. Federal estate taxes are only. Estate taxes are paid by the estate before the assets are distributed to beneficiaries while an inheritance tax falls to the person inheriting the asset.

You may have heard the term death tax but estate tax is the legal term. If youre concerned about passing your property to your heirs because of taxes dont be concerned. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax.

If someone dies and leaves behind a spouse who they were legally married to at the time of death the spouse is first in line to inherit. Florida doesnt collect inheritance tax. There is no federal inheritance tax but there is a federal estate tax.

The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax. 2 Inheriting at death is.

The federal government however imposes an estate tax that applies to residents of all states. This means if your. You have to pay taxes on the 100000 gain.

This law came into. If someone dies in Florida Florida will not levy a tax on their estate. The federal estate tax.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance. Nonetheless Florida residents may still have to pay inheritance tax when they.

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Attorney For Federal Estate Taxes Karp Law Firm

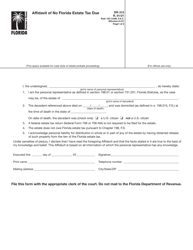

Affidavit Of No Florida Estate Tax Due Dr 312 Pdf Fpdf Docx

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Michigan Inheritance Tax Explained Rochester Law Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Eight Things You Need To Know About The Death Tax Before You Die

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Legal Advice To Avoid Taxes On Inheritance Super Lawyers Florida

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Inheritance Tax In Florida Legal Guide For 2022 Alper Law